Soo if you follow me over on Instagram than you know that the secrets out & I finally bought a house! I say finally because I’ve been (secretly) looking for over a year, signed my papers this March as an early 28th birthday present to myself & got my keys a little under a month ago! The entire home buying process was a much fun and I really enjoyed it, but only because I prepared myself for everything beforehand! As stated above, I looked around for an entire year before committing to a house! I knew I wanted to be truly happy in whatever decision I was making and wanted to make sure I was making the right one. Below, I’ve listed the 5 thing that I did before I signed those dotted lines to even start the home buying process. These 5 things really made my process a lot less stressful & I’m sure they can help you in your home buying process too! Disclaimer, I’m for sure no Realtor or financial advisor FYI, but these are just basic things that I think can help anyone!

Get Ya’ Money Right Girl!

My first thing I did before I started looking was a set a budget for myself. Doing this before I even started to look kept me in a realistic mindset of what I could afford. Let’s be honest- with Pinterest, it’s so easy to go crazy & want the world! For a single girl with two fur babies, I knew that I wanted a good sized house- not too small but certainly not too big! I sat down 8+ months before I began the home buying process & set a home budget that was attainable. I wrote down what I was currently paying monthly with all of my bills (my old rent included), and did some math to figure out what price range I wanted to look in. I knew beforehand that I wanted to build instead of buy, so this also played a large factor in my beforehand shopping. When making a budget, it was good to know three things:

- Your Current Deb to Income Ratio

- Your monthly goal of what you want to spend

- Your goal of how much $ you plan to save to put down on your house

Starting with #1, knowing my current Debt to Income was crutial in having an idea of the dollar amount I would be approved for, as well gave me an idea of if I could pay any small things off beforehand to make my ratio better. I am 100% proud to say that I hadno credit card debt, so my ratio was pretty solid. If you do have credit cards though, I would say try to pay them down if you can (and I’m about 90% positive any financial advisor would tell you the same thing!). Secondly, setting a goal of what I wanted to spend again put in my mind realistic expectations so I was prepared for when I actually started looking. And lastly, number 3 was the big eye opener! Saving for a house can seem a bit intimidating, but if you prepare beforehand it might make it sting a little less! Although saving such a large amount can seem 100% cray, I did the below things and it helped me a lot:

- I gave up small things that I didn’t really need. (EX: I stopped buying new shoes (don’t judge me, LOL) and limited my Starbucks to only once a week for a good 10 months. Also, I would only get my nails done during events or if I had a trip coming up. Same with other things that I didn’t really need- if I wasn’t doing anything special, it wasn’t necessary)!

- I sold lots of old things that I didn’t need! This went anywhere from old furniture that I wasn’t using and was stacking up in my garage to old clothes that literally still had price tags. Embarrassing, I know, but hey it made me some extra cash in the end!

- So I actually did this well before I decided I was going to buy a house, but cutting cable for sure helped save a good chunk of change every month! I have a fire stick & have Hulu live, which basically has all of the channels that I watch anyways. Along with Netflix, I’m 100% set and can watch all of my shows. This has worked out so great for me that I have actually convinced some family members to do the same!

Research Areas… & Take Your Time Doing So

Once I knew the (REALISTIC) budget that I wanted to buy within, I then started looking at areas. Living in Houston for the last 10 years give or take, I know my way around the city pretty well, but wasn’t as familiar with the suburbs. I knew I didn’t want to buy in the city, so I would dedicate some time every few weeks to go look around other areas in Houston. This might seem a little “extra”, but it really payed off for me in the end because I then knew exactly where I wanted to live! I looked around at all time of the day, which was really big for me too. Since I was buying as a single woman, I wanted to make sure that the area I was living in was not only beautiful during the day, but also safe at night. I looked in different neighborhoods until I found the right one. Once I found the right one, I visited many times as well as looked what was around the area. One thing that really excited me about my (now) neighborhood was that there were so many new stores, etc. nearby. That was a true sign to myself that I was moving to a growing area, which was a request on my list! I wanted to move somewhere that was up and coming vs. already established, for resale and other reasons.

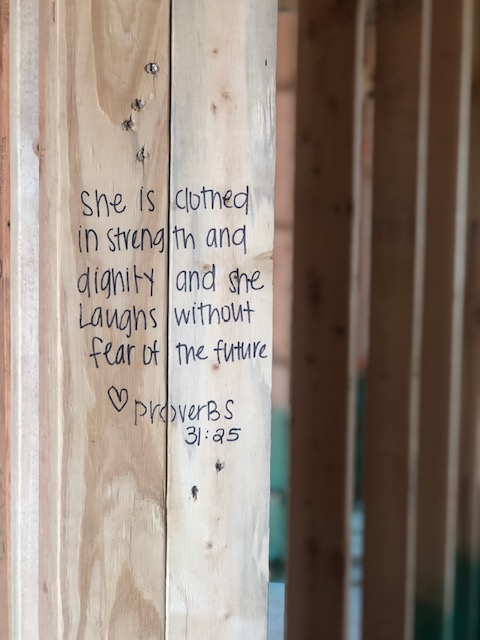

FUN FACT: I wrote my favorite bible verses on the beams all around my house! This one (my fav which is also tattooed on my wrist) is at my entryway.

Make a List..like a Realistic One

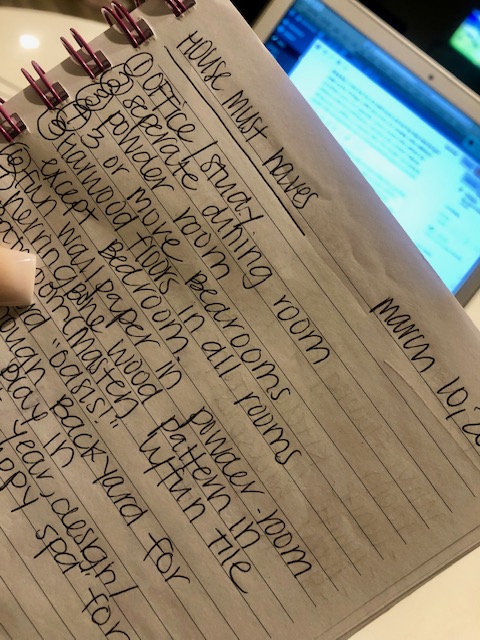

Once I did the two above things (make a realistic budget & look at areas), I then made a list of what I wanted in my house. Pinterest really set my expectations probably way too high, but I made my long list anyways. While doing this, I went into lots of model homes and saw how they were set up to make my list of things I 100% had to have. For example, white cabinets in my kitchen were a non negotiable. I knew I wanted white cabinets and refused to settle for anything less. I also knew that I wanted a separate dining room, in addition to a separate office. Even though I was buying by myself, I like having friends over- so having dedicated spaces to entertain was important to me!

Once I made my list, I was then able to take out some things that I probably wasn’t going to have in my house (like a wine cellar of course, HAHA!). I mean, for your first house, it’s perfectly normal to go beyond in your imagination what you actually need, and then re-evaulate. I also knew that I didn’t want carpet in any common areas, since I have two fur babies. After I made my list, I prioritized it numerically so I was able to be disciplined in what I actually ended up getting. A little sneak peek of my actual list is below. Peep the crazy things on there too, ha! Note, this list is not my final list, I went back after this one and prioritized a little more before coming up with my super final list. I signed a few weeks later to start building & that list was the FINAL one after I narrowed it down from about 2 pages, haha!

There were a lot of other things I did before finally choosing a house (don’t even get me started on the design studio process!), but the three above things I would say were the most important to be in being prepared. Doing these things not only ensured I was financially ready to make such a big step, but also ensured that I was committing to not only what I wanted, but also what I actually needed. I hope the above small steps help you too if you are also on your journey of purchasing your first home!

Until Next Time!,

B

I live in toronto I will never be able to buy a house. Good tips though!

Of course!

XOXO,

B

Thanks for these tips! It can be very overwhelming to try and buy a house. I still don’t know where I would like to live haha

Yes! Picking an actual area I think was one of the hardest spots!

XOXO,

B

Love these tips! Lots of important information in here before making such a big purchase! Thanks for sharing.

Of course!

XOXO,

B

Congratulations on buying a house – that is so exciting!

Thank you so much!

XOXO,

B

Whilst buying a house is NOWHERE in the near future for me, I am still taking in any and all advice on the process whenever it is available! I grew up moving from rental to rental and hated the uncertainty of it all, so I WILL buy a house, no matter how long it takes me to get there. With these great tips, hopefully I’ll be doing it right too!

Yesss! I’m rooting for you!

XOXO,

B

These tips were all very useful. I particularly liked your suggestion for making a detailed list. Making a detailed list surely makes it clear in your head about the things that you want and the things that you don’t.

Yes! Making a list was so important!

XOXO,

B

You are so smart, in the way you planned and looked and prioritized your lists of “must haves”. That’s the right way to buy/build a house. I’ve been a realtor for 16 years and you are a rarity!

Ahhh thank you so much!

XOXO,

B

I absolutely love these tips! I’ve never learned such incredible life lessons as I did when we bought our house. It took 7 years to get out of our apartment and we spent so much time paying down debt, fixing our credit and debt to income ratios and organizing paperwork for basically every penny we ever brought in and why. Then we were bombarded with a brand new house and all of its needs and weren’t sure where to even start. I love these tips for buying a house, definitely pinning to help someone else!

Ahh that’s awesome! I’m so glad I could share the things that I’ve learned!

XOXO,

B